Gradual increases in Chinese residents’ disposable income, more people undergoing plastic surgery at younger ages, and the aging population have exacerbated consumer expansion for plastic microsurgeries.

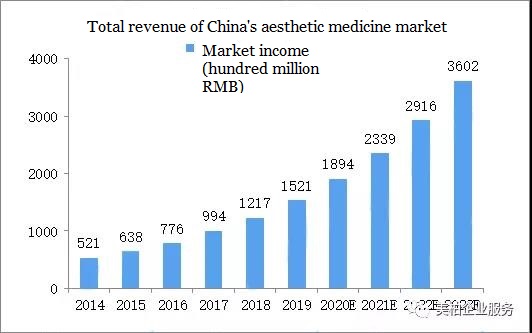

According to statistics from the Health Commission, the total revenue of China’s aesthetic medicine market reached RMB 52.1 billion in 2014, and it will grow to RMB 152.1 billion by 2019. The domestic demand for aesthetic medicine is increasing year by year, and it is estimated that the total revenue of the domestic aesthetic medicine service market will reach RMB 360.1 billion in 2023.

▲Figure 1: Total revenue of China’s aesthetic medicine service market

Data source: compiled by the National Health Commission and MyBioGate

At the same time, Chinese pharmaceutical companies are actively taking part in the aesthetic medicine market, especially in the context of 4+7 national centralized procurement. In order not to be affected by serious medical insurance policies, pharmaceutical companies have focused on non-urgent aesthetic medicine to seek differentiation from other companies, thus beginning a corporate transformation.

China’s aesthetic medicine market has a low penetration rate and a fast growth rate

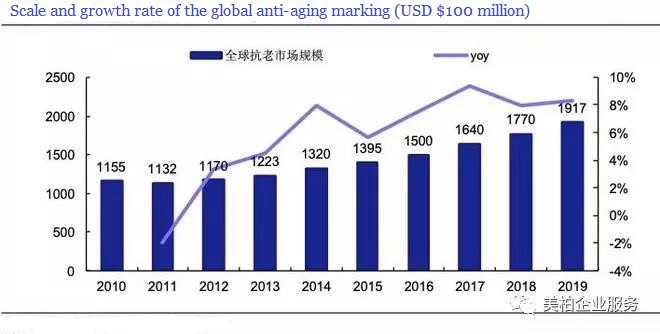

According to a report released by Zion Market Research in 2017, the global anti-aging market will reach US$177 billion in 2018 and US$216 billion in 2021, a year-on-year increase of 7.5% [1].

Source: Zion Market Research, Essence Securities Research Center

According to Forbes’ statistics, China’s anti-aging product market has reached RMB 4.5 billion, but RMB 100 billion of development remains.

Botox: Breaking the previous monopoly, a recent influx of many new players

The botulism product market ranks first in China

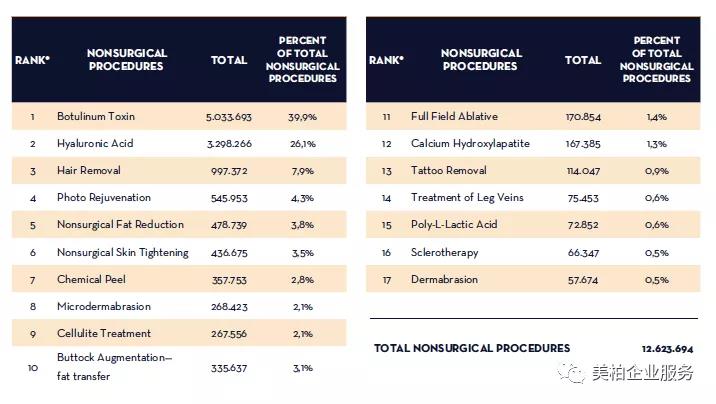

In the non-surgical aesthetics medicine market in China, injectable projects led by hyaluronic acid and botulinum toxin have become the main driving force for the accelerated expansion of the global aesthetic medicine industry. According to the “2017 Full Global Survey Results” data released by the International Society of Aesthetic Plastic Surgery (ISAPS, International Society of Aesthetic Plastic Surgery) on November 1, 2018, China ranks among the top ten in the global plastic surgery market. According to the statistics of countries where plastic surgery is offered, botulinum toxins accounted for 39.9% of total non-surgical treatments and ranked first among non-surgical aesthetics medicine, and hyaluronic acid injections accounted for 26.1%.

Figure 3: The number of non-surgical treatments in the top 10 countries where plastic surgery is offered in the world

Source: ISAPS-2017 Full Global Survey Results, Meibo Medical

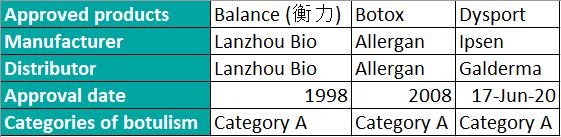

China approves 3 new botulism products

Because their neurotoxic hemp products are state controlled, the market has long been exclusively enjoyed by Allergan’s Botos and China Biotech (Lanzhou Biotech). Their products occupy the middle and low-end markets. In June 2020, as China has been preventing and controlling the COVID-19 epidemic, a blockbuster news report spread amongst the medical beauty circle about Bofu-Ipsen (Tianjin) Pharmaceutical Co., Ltd. Botulinum toxin type A (Dysport 50U) for injection” was officially approved by the NMPA, breaking the silence of China’s 12-year botulinum approval. Since then, the majority of China’s botulism market has been controlled by these three companies.

Source: NMPA (National Medical Products Administration), compiled by MyBioGate

Source: Public information, compiled by MyBioGate

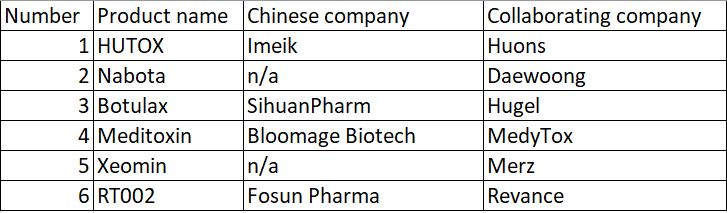

A number of botulism products are actively undergoing clinical trials in China

At present, many domestic Chinese companies such as Huaxi Biology, Sihuan Pharmaceutical, and Amec are cooperating with foreign botulinum toxin manufacturers. The clinical trials of “Botulinum Toxin Type A for Injection” are being carried out in China. Many products are in the trial phase. These include RT002 from Fosun Pharma and Revance, Meditoxin from Huaxi Biotech and Medytox, Hutox from Amec and Huons from South Korea, Nabota from Daewoong Pharmaceuticals from Daewoong Pharmaceutical, Botulax from Sihuan Pharmaceuticals and Hugel, and Xeomin from Merz.

Source: Public information, MyBioGate

On June 29, 2020, Fosun Pharma’s RT002 was accepted by the Food and Drug Administration. It was introduced by Fosun Pharma from Revance in December 2018. They paid up to US$88 million in licensing fees and corresponding sales milestone payments.

Source: Public information, MyBioGate

Hyaluronic acid: fierce competition, weak premium ability of local brands

Huaxi Biological dominates the upstream raw material market

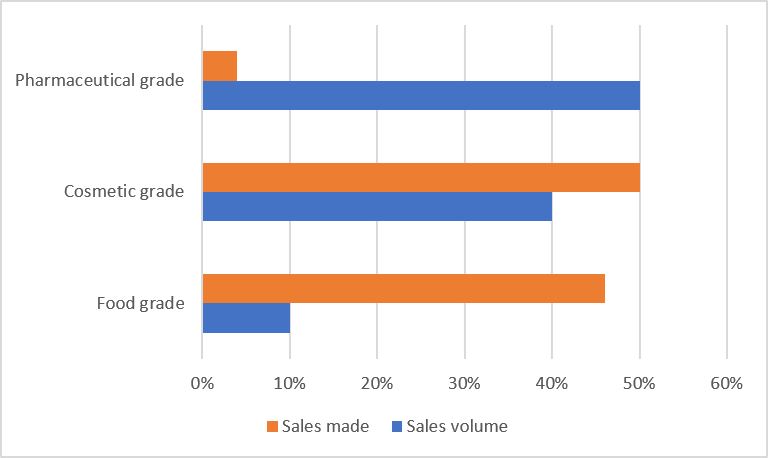

The global hyaluronic acid raw material market is developing steadily. In 2018, the total sales volume reached 500 tons. It is expected that the compound annual growth rate of 18.1% will be maintained from 2018 to 2023. In 2018, China’s total sales of hyaluronic acid raw materials accounted for 86% of global sales. Among them, Huaxi Bio is the world’s largest hyaluronic acid production and sales company. In 2018, its sales accounted for 36%, far surpassing the second-ranked Focus Biological (about 12%).

The price of pharmaceutical grade hyaluronic acid raw materials is much higher than cosmetic grade. According to Huaxi Biotech, the price of Huaxi cosmetics food-grade hyaluronic acid raw materials in 2019Q1 was RMB 2226/kg and RMB 1370/kg; the price of eye drops-grade hyaluronic acid in 2019Q1 was RMB 17,000/kg; the injection grade was the highest, exceeding RMB 100,000/kg.

Source: Huaxi Biotechnology, research data from Guoyuan Securities Research Center

Hyaluronic acid products have fierce competition and strong premium brand ability

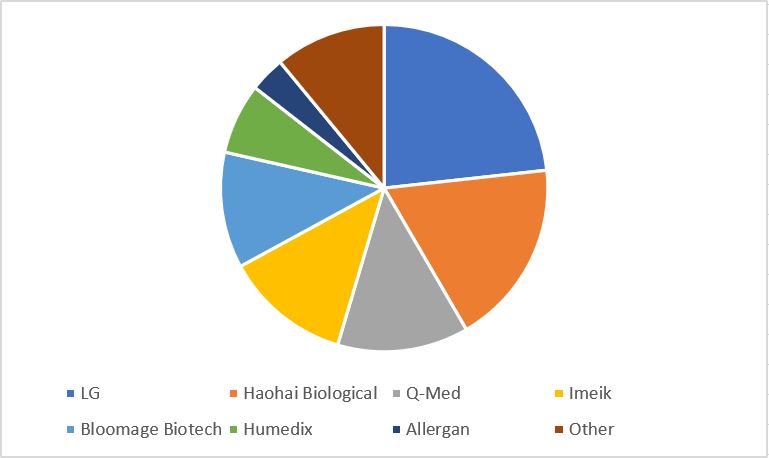

Compared with the international market, aesthetic medicine customers in China prefer hyaluronic acid. In the scale of China’s aesthetic medicine injection products in 2018, hyaluronic acid accounted for 66.6%, a year-on-year increase of 53.1%, and botulinum toxin ranked second, accounting for 32.7%, a year-on-year increase of 90.6% [4]. Today, 14 domestic and foreign companies in China have approved hyaluronic acid products in the NMPA, including 8 local companies in China. They are Amec Bio, Huaxi Bio, Hao Hai Bio, Monbron Bio, Scientific Bio, Concord Medical, Hekang Biology, Changzhou Institute of Medicine.

In the fiercely competitive hyaluronic acid market, companies expanded into the market in both low price and high price products to maintain net profits. From the perspective of market sales, South Korea’s LG Ewan series took the top spot, and Haohai Biology ranked second.

Source: Frost & Sullivan, MEBO Healthcare

In terms of sales, foreign-funded enterprises have more premium brand capabilities. In particular, Allergan, whose sales accounted for only 3.5% but can get 19.4% of sales, ranked second. This is inseparable from the positioning of its hyaluronic acid products (Qiao Yadeng) as the highest-end luxury brand.

Collagen injection: the market with large potential that has not received much attention

In recent years, many skin care products and pharmaceutical manufacturers have turned their attention to collagen and have successively developed related cosmetics and oral liquids. However, they put collagen into the clinical application in the field of microplastics. Currently, only two products have been approved for legal sale by the China Food and Drug Administration. They are Shuangmei I from Taiwan Shuangmei and Fumida from Changchun Botai.

Source: Public information, compiled by MyBioGate

Collagen regeneration to lead a new fashion in aesthetic medicine

Here are examples of three companies with industry layout.

①Imeik-Bonita (approved)

Source: Public information, compiled by MyBioGate

Imeik developed a long-acting injection filler which contains 80% composite hyaluronic acid and 20% microspheres. Hyaluronic acid can play both a supporting and filling role. The microspheres can continuously stimulate the growth of their own collagen and maintain the dynamic balance of subcutaneous collagen. This is also the reason why the Bonida effect can be maintained for a long time.

②Arte Coll (approved)

Arte Coll is a long-acting injection filler developed by Hafod Bioscience GmbH in the Netherlands. It contains 20% microspheres (microsphere prosthesis) and 80% collagen solution, containing 6 million 32-40 micron Aibefu microspheres per ml.

③East China Medicine-Girl injection Ellansé (in registration)

Ellansé is a star product by Sinclair, UK. Sinclair is headquartered in London, England. It is a professional aesthetic medicine company with world-leading aesthetic medicine technology and global operations. With Sinclair’s core product Silhouette embedding thread series and Ellansé injection long-acting microspheres, its technology level is in the leading position in the industry. The main component of Ellansé is polycaprolactone (PCL microcrystalline balls, one is a CMC carrier). The production of collagen should be more natural within 1-3 months.

It is worth mentioning that on November 8, 2018, Huadong Medicine issued an announcement stating that the cash offer to acquire all shares of Sinclair Pharma, a British aesthetic medicine company, has been completed. The purchase price was 32 pence per share and the total transaction amount was RMB 1.52 billion.

In addition, international collagen injections are also popular. Just last week (early August 2020), Geltor, a US company that provides collagen without animal ingredients for the beauty, food and other industries, received US$90 million in financing.

Geltor is a collagen manufacturer founded in 2015 and headquartered in San Francisco. It was co-founded by Alexander Lorestani and Nick Ouzounov to provide consumers with collagen based on cell cultures. According to data released by the market research company Grand View Research, by 2027 the global collagen market is expected to reach US$7.5 billion, and the gelatin market will reach US$6.7 billion in the same period.

Conclusion

Based on the above industry analysis, we believe that China’s aesthetic medicine industry, especially the non-surgical aesthetic medicine industry is still in a period of rapid development, with a compound annual growth rate of more than 20%. Companies such as Huaxi Biology and Haohai Biology continue to focus on the field of aesthetic medicine, while companies such as Huadong Pharmaceutical, Fosun Pharma, Sihuan Pharmaceutical and other companies have added to the aesthetic medicine track to continue to provide a new impetus for the growth of China’s medical aesthetics market. We have also observed that after in-depth research, the introduction of high-quality products from overseas (including Fosun Pharma’s License In Revance and Huadong Pharma’s acquisition of Sinclair) will provide a guarantee for companies to quickly enter the aesthetic medicine market.

Source:

1、《Anti-Aging (Baby Boomer, Generation X and Generation Y) Market, by product (Botox, Anti-Wrinkle Products, Anti-Stretch Mark Products, and Others), by Services (Anti-Pigmentation Therapy, Anti-Adult Acne Therapy, Breast Augmentation, Liposuction, Chemical Peel, Hair Restoration Treatment, and Others), by Device (Microdermabrasion, Laser Aesthetics, Anti-Cellulite Treatment and Anti-Aging Radio Frequency Devices) : Global Industry Perspective, Comprehensive Analysis, Size, Share, Growth, Segment, Trends and Forecast, 2015 – 2021》 Zion Market Research

2、《2018 ISAPS Global Statistics》Dec 3, 2019 International Society of Aesthetic Plastic Surgery 2018 Annual Data Report

https://www.isaps.org/wp-content/uploads/2019/12/ISAPS-Global-Survey-2018-Press-Release-Chinese.new_.pdf

3、《2017 Full Global Survey Results》Nov 1, 2018 International Society of Aesthetic Plastic Surgery 2017 Global Survey Report

https://www.isaps.org/wp-content/uploads/2018/10/ISAP2016_17_comparison.pdf

- “2018 New Oxygen Aesthetic Medicine White Paper”

- 2019 Fosun Pharma Annual Report

- 2019 East China Medicine Annual Report