Author: Chen Chun

Editor: Youwen Dai

COPD is the third-highest cause of mortality

When discussions come up of lung cancer and its dangers and fears of new coronary pneumonia, the most common respiratory disease is sometimes ignored, COPD (chronic obstructive pulmonary disease), the world’s third most fatal disease. According to the Global Burden of Disease Research Report, there were 251 million cases of chronic obstructive pulmonary disease worldwide in 2016 【1】, and an average of one person died of COPD every 10 seconds. In addition, COPD has a long course, and patients often need frequent medical visits and hospitalization and long-term care due to acute exacerbations, which consumes a lot of medical resources. It has become a thorny global disease burden, and it has attracted more and more attention from scientists, pharmaceutical companies, and investors.

▲Figure 1 Global COPD mortality rate in 2017

Source: Li etal. BMJ. 2020;368:m234.

The COPD market is large, with many unmet needs

In 2018, the global COPD market exceeded US$10 billion. In 2030, it is expected to reach US$20 billion.

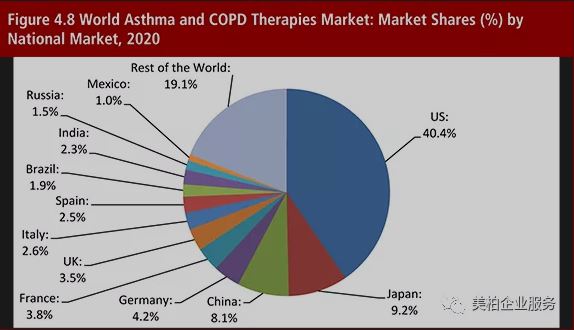

According to a research report by Research and Markets, the market value of COPD in 2018 was approximately US$10.9 billion, with a compound annual growth rate (CAGR) of approximately 5.9%, and it is expected to reach US$19.3 billion in 2028 【2】. Among them, the US market accounts for about 40% of the COPD market and developed regions such as Europe and Japan account for 18% and 9.2% respectively. In China, the COPD drug market has developed steadily in recent years. According to PDB data, the domestic Chinese COPD market in 2018 is was RMB 2.2 billion (approximately US$324 million). The compound growth rate reached 15.56% 【3】. The rapid growth of the COPD market is mainly due to the increasing incidence of COPD worldwide, but the cause of COPD varies by geographic region.

▲Figure 2: The global market share for asthma and COPD in 2020

Source: Asthma and COPD Therapies Market Forecast 2015-2025

There are four main difficulties in diagnosing COPD

- Difficulty in diagnosis of COPD

COPD often develops insidiously. Once clinical manifestations appear, it often indicates a gradual decline in the overall health of the patient and a gradual increase in respiratory symptoms. Early diagnosis of COPD is difficult.

- Inaccurate spirometry

The COPD global initiative (global obstructive lung disease, GOLD) listed forced expiratory volume in 1 second (FEV1) and forced vital capacity (FVC) ratio <0.7 as the diagnostic criteria for COPD 【4】. However, using this standard in clinical practice is controversial.

- COPD heterogeneity and overlap with asthma symptoms

Asthma and COPD have many similar symptoms, including shortness of breath, coughing, and decreased tolerance to exertions from physical activity.

- COPD delayed diagnosis

The lack of knowledge about COPD by some medical workers is a reason for its delayed diagnosis.

Existing drugs treat the symptoms but not the root cause. Anti-inflammatory drugs are a research hotspot

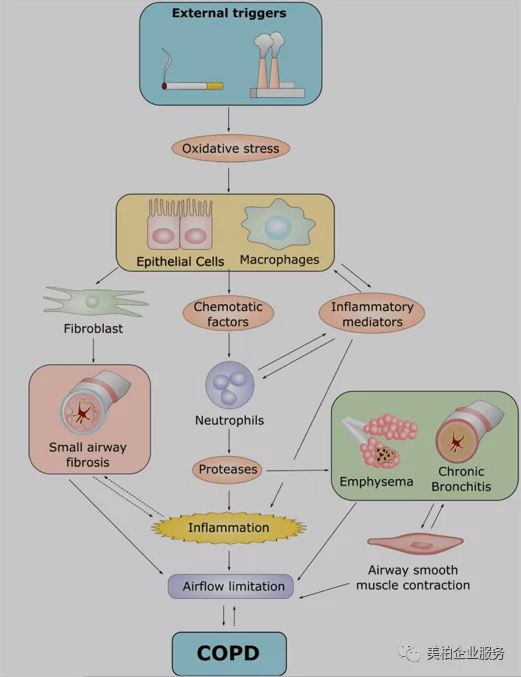

There is currently no cure for COPD. The drugs for COPD mainly rely on bronchodilators that can regulate breathing airways. Such drugs can only relieve symptoms and delay the deterioration of the disease. They treat the symptoms but not the root cause. As the role of inflammation in COPD has attracted more and more attention, people have begun to consider the development of drugs that go after different targets. Eliminating inflammation could become the most direct way to truly treat COPD.

▲Figure 3 Pathogenesis of COPD

Source: J. Med. Chem. 2019, 62, 13, 5944–5978

When the respiratory tract is infected by external stimuli, it initiates an immune response by activating airway epithelial cells, macrophages and neutrophils. The chemokines released during inflammation play a vital role. Chemokines can attract neutrophils and lymphocytes, and at the same time activate adaptive immunity, which will further increase neutrophil inflammation. All activated cells, including epithelial cells, macrophages, neutrophils and lymphocytes, will promote the release of inflammatory mediators. Some of these specific inflammatory mediators, such as cytokines, chemokine receptors, lipid mediators and oxidative stress are potential targets for the treatment of COPD-related inflammation.

At present, there are mainly the following types of small molecule drugs that target inflammatory mediators: cytokine inhibitors and chemokine receptor antagonists; NLRP3 inflammasome inhibitors; LTB4 synthesis regulators.

Cytokine inhibitors and chemokine receptor antagonists

Cytokines and chemokines play a very important role in immune response, but the research on small molecule cytokine inhibitors is not developed. Most of the work on chemokine receptor antagonists was developed by AstraZeneca. AZD-5069 was a phase II clinical study treating COPD completed in 2011, but no more progress has been seen since then. Merck’s Navarixin has also entered the second clinical phase for COPD, but it was terminated December 2018.

NLRP3 Inflammatory Body Inhibitor

NLRP3 inflammasome can induce the production of cytokines IL-1β and IL-18. The increase of IL-1β can activate macrophages, cause neutrophils to inflame and cause COPD, while the increase of IL-18 can lead to the decline of lung function. NLRP3 inflammasome inhibitors can indirectly block the cytokines IL-1β and IL- 18’s inflammatory effect. However, the current clinical studies of this target drug for COPD are very limited, and only a few reports have been released related to COPD, such as MCC950, auranofin, TAK-242, bromoxone【5】.

LTB4 synthesis regulator

LTB4 activates neutrophils and macrophages and plays an important role in inflammation. Studies have shown that COPD is associated with elevated LTB4 levels. Regulating the biosynthesis of LTB4 by antagonizing the LTB4 receptor is a potential treatment strategy for COPD. However, the clinical results of these inhibitors for the treatment of COPD are not optimistic. Among them, Gemilukast developed by Ono Pharmaceutical for the treatment of bronchial asthma has entered the second clinical phase, but there has been no progress since 2014, and no COPD research has been carried out. Only Mariposa Health’s TA-270 for the treatment of asthma and COPD is still in the phase II clinical study 【6】.

Complex inhalation medicine and high barriers to inhalers

As mentioned earlier, inhaled medication has played an important role in the fields of COPD and asthma, accounting for 80% of all formulation. There are four main types of commonly used inhalation, nebulizer, dry powder inhaler (DPI), aerosol inhaler (MDI) and inhalation soft mist devices (SMI), but the inhaled formulation is complicated to perfect, posing a high technical barrier.

Strict requirements for inhalation particle size

The solution or powder used in inhaled medicine has strict requirements on particle size. Their efficacy depends on the amount of deposits in the lungs. Their particle size also plays an important role. According to the physiological structure of the respiratory tract, in order to effectively deposit the drug on the treatment site, the ideal particle size of the drug should be less than 1-5 μm. If the particle size is too large (>10μm), the particles will be deposited in the oropharynx. If the particle size is too small (<0.5μm), the drug may not be deposited and the efficacy will be reduced. In order to achieve the medicinal effect, the inhalation preparation needs to achieve precise control of the particle size and the stability of the dosage for each use. This undoubtedly places extremely high requirements on the drug prescription design and inhalation device design of inhaled preparations【7】.

Inhaled medications need to consider the nature of the drug in many aspects when designing the drug prescription

Aerosols can be divided into solution type, emulsion type and suspension type. Among them, the ratio of the main drug, propellant, cosolvent, and surfactant has a greater impact on the propelling power and stability of the drug, the particle size and the content of each spray. At the same time, the compatibility of the drug with the inhaler, the stability of the crystal form of the drug, the reasonable lung deposit rate of the drug and the drug fluidity also need to be considered.

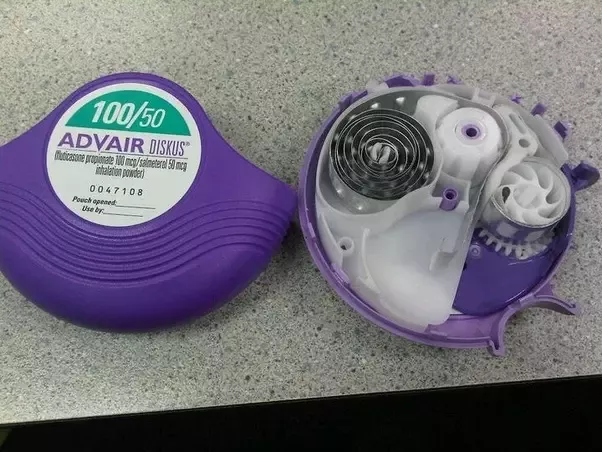

Inhalers are a high-barrier technology to replicate

Respiratory inhaled medicine is combination of medicine and equipment and require special devices. However, replicating inhalers is difficult. Taking aerosols as an example, the aerosol filling process includes the steps of drug addition, valve packaging, propellant loading, safety testing and nozzle assembly. It involves the inhaler’s material and thickness, drug volume, phase pressure and temperature in the tank as well as overall sealing efficacy【8】.

▲Figure 4: Internal structure of Advair inhaler

Source: Quora

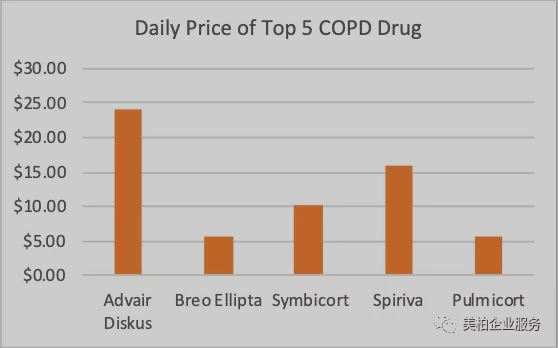

Expensive treatment

Due to the complex processes, it is necessary for pharmaceutical companies to develop not only small molecule drugs but also respiratory devices. This means only MNC have the financial ability to enter the COPD market. However, the high prices of drugs sold by these large pharmaceutical companies have made it difficult for low-income people to afford them. Moreover, COPD is a chronic disease. For some serious patients, it is often necessary to use several drugs at the same time. As can be seen from the figure below, the top five COPD drugs sold cost more than $5 per day. Advair’s inhaler costs US$23.98 per day. The high price makes low-income groups and patients in underdeveloped areas unable to afford it, which explains why more than 90% of COPD deaths occur in low- and middle-income countries.

▲Figure 5: Daily treatment cost of the top five COPD drugs

Summary

Drug prices usually lower when generic drugs enter the market, but the market for asthma and COPD drugs are relatively specialized. Although there are already some prescriptions for COPD brand drugs that have lost their patent protection, how to make inhaled medicine and inhalers devices have patent protection, and the patent protection period is longer than that of drugs. Moreover, inhalers themselves have high production and design barriers. The high cost can restrict small companies, affect the subsequent R&D process and increase the expenses for generic drug development.

For inhaled drugs, the drug itself is the lowest cost component, not exceeding 3% of the price. Packaging materials represent the highest cost, often reaching 50% of the price. The reason is that there are technology and patent barriers for inhaler valves and containers. The core production and preparation technology has been mastered by upstream packaging material suppliers, and there are almost no comparable products on the market. This makes it almost impossible to reduce overall costs even with generic drug prescriptions.

Finally, even if the aforementioned difficulties are overcome, obtaining FDA approval is by no means easy. Respiratory medicine usually has a small single drug dose (less than 1 mg, often between a few hundred micrograms), and oral and nasal drug doses is less than 50%, making it difficult to achieve bioequivalence for generic drugs. FDA approval conditions are more stringent. FDA approval of inhaled generic drugs requires that the prescription and device are similar to the original research, the systemic test is the same, the in vitro exposure PK is the same, and the clinical efficacy is the same to determine the bioequivalence. This led to the FDA’s refusal to approve three generic Advair drugs. The first generic drug was not approved until January 2019. Therefore, there are few generic respiratory medications on the market, and high-priced brand-name drugs are still the most represented 【8】.

Large corporations monopolize the market, delivery platforms and new target drugs are broken

The three leading companies GSK, AZ, and BI monopolize the market

GlaxoSmithKline, AstraZeneca and Boehringer Ingelheim are the dominant manufacturers of COPD and asthma medication. Of the US$24 billion in sales for COPD and asthma drugs in 2019, GSK, AZ, and BI accounted for 35%, 21%, and 14% respectively, with a total share of 70% of the market【9】.

The overall sales of inhaled medicine are relatively high, with 6 varieties having annual sales of more than US$1 billion. GSK’s total sales revenue of these kinds of products is US$8.534 billion. Although this revenue has declined slightly from previous years, GSK is still the leader in the global market. AstraZeneca and Boehringer Ingelheim respectively rely on Symbicort (formoterol/budesonide) and Spiriva (tiotropium bromide) for sales revenue in this field, occupying the second and third place【10】.

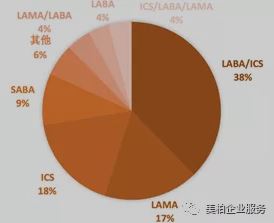

In the medication category, long-acting beta receptor agonists/inhaled corticosteroids (LABA/ICS) have the largest representation in asthma and COPD medication. In 2019, the LABA/ICS brand-name drug market was US$9.12 billion, accounting for 38% of the overall market. The top three best-selling varieties were GSK’s Advair and Bero and AstraZeneca’s Symbicort.

Advair is the world’s first LABA/ICS drug. It reached peak sales of US$6.468 billion in 2013. Breo is GSK’s second ICS/LABA product launched in May 2013 after GSK. Compared with the former, this product only needs to be administered once a day and uses the easier-to-learn drug delivery device Ellipta. AstraZeneca’s Symbicort is now the flagship product of their LABA/ICS drugs. Sales in 2019 surpassed Advair and was the highest of the three at US$2.495 billion.

Meanwhile, ICS and LAMA account for 18% and 17% of the market respectively. In the LAMA market, Boehringer Ingelheim’s Spiriva basically monopolizes this area. In 2019, the drug was the highest-selling product in the global asthma/COPD market, reaching US$2.734 billion, accounting for 67% of the LAMA market. Although the triple combination of LAMA/LABA/ICS currently only occupies 4% of the drug market, it is more effective than the two-combination therapy in reducing acute inflammation. It is expected to become a best seller in the next few years. GSK’s Trelegy Ellipta was approved by the FDA for maintenance treatment of COPD in September 2017. It is the world’s first triple therapy that only needs to be administered once a day. It was successfully listed in China in 2018. AstraZeneca’s Breztri Aerosphere followed closely behind and was launched in Japan and China in 2019. In addition, there are biological drugs and LAMA/LABA two-part combination medications which together constitute the entire asthma/COPD medication field 【11】【12】.

▲Figure 7: Distribution of asthma/COPD medication categories in 2019

Company inventories

There are differences in the proportion of dosage forms used in China and overseas. In China, nebulizers are the most prevalent due to later diagnosis for patients. To meet the needs of different populations in the overseas market, aerosols (MDI) and powder sprays (DPI) provide patients more choices.

3M is committed to bringing high-quality generic inhalation medication to the market at a low cost. 3M has extensive experience in product development and handling patent issues. It has achieved satisfactory results in obtaining MDI approval from global regulatory agencies. 3M is knowledgeable about the composition ratio, design and manufacture of inhalation devices, and the FDA review process.

2. Vectura

The development of inhaled medication is very complex and challenging. Vectura can help customers overcome these challenges through advanced formulation technology and deep scientific knowledge, thereby maximizing the possibility of drug marketing. Vectura can provide support for DPI, pMDI and nebulizer products for small molecules, biological agents, compound drugs and general products.

3. Merxin

Merxin adopts the concept-to-launch method to provide complete solutions and professional information for the design and manufacturing of inhalers to speed up the approval process for generic drugs. The devices currently developed by Merxin include:

MRX001 — BLISTERMULTIDOSE DPI

MRX002 — PET VIAL FORPMDI FORMULATIONS

MRX003 — CAPSULE DPI

MRX004 — FINE SOFTMIST INHALER

MRX006 — DUAL CAVITYFOR TRIPLE THERAPY DPI

4. Manta

Manta focuses on the development of low-cost passive DPI inhalers. Manta can help pharmaceutical companies find a suitable inhaler and optimize dosage according to drug delivery requirements. They help new drugs to quickly enter the approval process.

Inventory of new target innovative drug companies

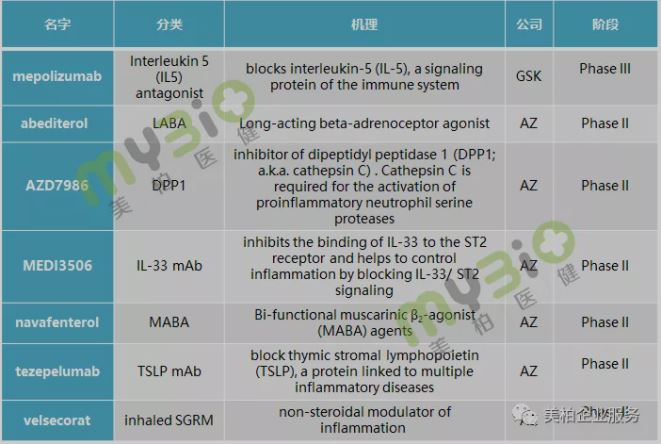

In the field of COPD treatment, GSK and AstraZeneca did not stop at the development of bronchodilators. In particular, AstraZeneca, in order to gain an absolute advantage in the treatment of respiratory diseases, earlier acquired Pearl Therapeutic, which focuses on the development of inhaled small molecule therapies. AstraZeneca is now actively deploying COPD targeted drugs. There are as many as four targeted drugs on the pipeline today, all of which are in clinical phase II.

GSK is not far behind in targeted drugs. The IL5 antagonist mepilizumab developed by the company has now completed two phase III clinical studies. In a paper published in The New England Journal of Medicine, it is mentioned that 100mg mepolizumab can significantly reduce the rate of deterioration of moderate to severe patients【13】. However, due to the inconsistent efficacy of mepilizumab in the two studies, the FDA rejected the application.

▲Figure 9: COPD drugs from GSK and AZ

- Ensifentrine (Verona Pharma)

Ensifentrine is a phase 2 clinical drug from Verona Pharma. Ensifentrine can inhibit phosphodiesterase (PDE) proteins PDE3 and PDE4. Studies have found that PDE3 is related to the contraction of the smooth muscle in the respiratory system, and PDE4 plays a key role in the inflammatory response caused by immune cells. Therefore, ensifentrine has the dual effects of being a bronchodilator and target drug. In 2019, ensifentrine completed its clinical phase 2 part A trial. The results showed that according to the FEV1 data of monitored patients, the ensifentrine experimental group can significantly improve lung function over the placebo group. Ensifentrine is currently undergoing clinical phase 2 part B trials (NCT04091360). Part B will study different doses of ensifentrine. They expect that related experiments will be completed in the first half of 2021【14】

2. Acumapimod (Mereo BioPharma)

Acumapimod (CT-197) is an oral p38 MAP kinase inhibitor. In 2018, the Phase 2 clinical trial was completed, with the results reaching the Phase 2 target. Now it is ready to carry out Phase 3 clinical trials. Phase 2 experimental results show that acumapimod can effectively reduce the acute admission and deterioration of COPD patients. It is expected to become the first-line treatment for severe acute exacerbation of chronic obstructive pulmonary disease (AECOPD) 【15】

3. SB010 (Sterna Biologicals GmbH & Co.)

SB010 was developed by Sterna Biologicals GmbH & Co. and is a GATA-3 antagonist. GATA-3 is a primary transcription factor that regulates inflammatory diseases (such as COPD and asthma) caused by Th2. By inhibiting GATA-3, it can regulate the expression of IL-4, IL-5, IL-13 and other cytokines that cause inflammation. According to the initial results of part A of the phase 2 experiment, inhaling SB010 can reduce the eosinophils in the sputum of patients. This result confirms that the GATA-3 pathway is very important in related inflammatory diseases caused by Th2【16】

4. FF4A protein

A study of COPD targets was published in Science Translational Medicine in August this year. Studies say that the FF4A protein may become a potential target for the treatment of COPD. FFA4 is usually found in the intestines and pancreas and can be activated by common dietary fats (such as omega-3 fatty acids). Once activated, FFA4 can effectively control blood sugar levels. The study also found that FFA4 protein is also abundant in lung epithelial cells and that this protein may be beneficial to the repair of lung tissue under the activation of omega-3 fatty acids. This provides new ideas for the treatment of COPD【17】

5. IL-32 is expected to be a diagnostic indicator

Research on COPD targets can not only provide new directions in drug development, they may also exert potential in early diagnosis of COPD. In July this year, a Chinese team published an article in Nature Scientific Reports on the relationship between the concentration of the cytokine IL-32 and the clinical diagnosis of COPD. The article pointed out that the blood cytokine IL-32 concentration of COPD patients was significantly higher than that of healthy people【18】. Although the role of IL-32 in promoting airway inflammation has yet to be confirmed, the detection of IL-32 concentration in the blood is expected to become a new way to diagnose and assess the severity of COPD and to solve the global bottleneck of COPD diagnosis.

About the Author

Chen Chun is an investment analyst at MyBioGate and a PhD candidate in the Department of Chemistry at Boston University, majoring in organic synthesis of natural products and drug development. Co-founder of Boston University Biotechnology Business Club, member of Tufts University and Massachusetts Institute of Technology Consulting Club, active in the pharmaceutical science industry in the Greater Boston area.

Reources:

【1】Lancet. 2007;370(9589):741-750.

【2】Research and Markets report: Insights on the Worldwide COPD Market to 2028

【3】PDB database

【4】World Health Organization official website

【5】J Med Chem. 2019;62(13):5944-5978.

【6】Yaodu: Small molecule drugs targeting inflammatory mediators in COPD anti-inflammatory strategies

【7】Head Leopard Research Institute Overview of China’s Respiratory Inhalation Preparation Industry in 2019

【8】Head Leopard Research Institute Overview of China’s Respiratory Inhalation Preparation Industry in 2019

【9】Medical Rubik’s Cube Info: Overview of the US$20 billion asthma/COPD drug market

【10】N Engl J Med 2014; 371:1198-1207

【11】Annual report of GlaxoSmithKline, AstraZeneca and Boehringer Ingelheim

【12】Verona Pharma official website

【13】Inhaled medication for the Department of Respiratory Medicine of the National Trust Institute of Evidence Economics: the emergence of high imitation “no man’s land”

【14】Mereo BioPharma official website

【15】Annual reports of GlaxoSmithKline, AstraZeneca and Boehringer Ingelheim

【16】Sterna Biologicals official website

【17】Science Translational Medicine 19 Aug 2020: Vol. 12, Issue 557, eaaw9009

【18】Scientific Reports volume 10, Article number: 12092 (2020)